Estate Planning Attorney Things To Know Before You Buy

Estate Planning Attorney Things To Know Before You Buy

Blog Article

The Best Guide To Estate Planning Attorney

Table of ContentsAn Unbiased View of Estate Planning Attorney8 Easy Facts About Estate Planning Attorney DescribedGetting My Estate Planning Attorney To WorkThe 7-Second Trick For Estate Planning AttorneyAll About Estate Planning AttorneySome Known Details About Estate Planning Attorney All About Estate Planning Attorney

That you can stay clear of Massachusetts probate and sanctuary your estate from estate taxes whenever feasible. At Center for Senior Citizen Legislation & Estate Preparation, we know that it can be hard to believe and talk regarding what will happen after you die.We can aid. Call and set up a totally free assessment. You can likewise reach us online. Offering the greater Boston and eastern Massachusetts locations for over three decades.

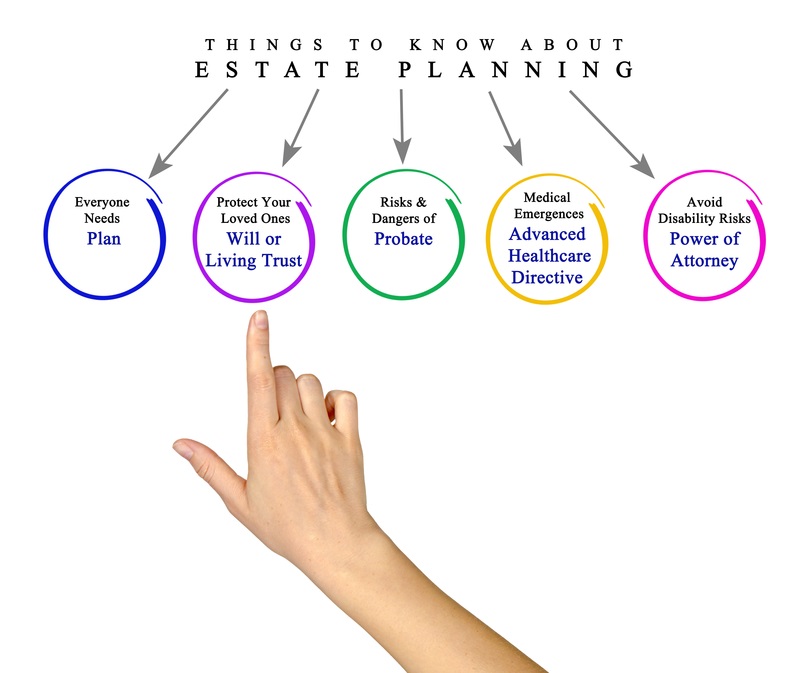

They can supply accurate guidance tailored to your certain scenario. They help you produce a comprehensive estate plan that straightens with your desires and objectives. This may consist of drafting wills, developing depends on, marking beneficiaries, and extra. Estate planning attorneys can help you stay clear of mistakes that could revoke your estate strategy or result in unplanned consequences.

Facts About Estate Planning Attorney Uncovered

Working with an estate preparation attorney can aid you stay clear of probate entirely, saving time, and money. An estate planning attorney can help safeguard your possessions from suits, financial institutions, and various other insurance claims.

To learn concerning actual estate,. To learn about wills and estate preparation,.

The age of majority in a given state is set by state laws; typically, the age is 18 or 21. Some assets can be dispersed by the establishment, such as a bank or brokerage company, that holds them, as long as the owner has provided the appropriate instructions to the banks and has named the recipients that will certainly get those assets.

4 Simple Techniques For Estate Planning Attorney

If a recipient is named in a transfer on death (TOD) account at a broker agent company, or payable on fatality (COVERING) account at a financial institution or credit union, the account can typically pass straight to the recipient without going through probate, and therefore bypass a will. In some states, a comparable recipient designation can be included in property, permitting that property to also bypass the probate process.

When it involves estate planning, an experienced estate lawyer can be an invaluable property. Estate Planning Attorney. Collaborating with an estate planning attorney can supply countless benefits that are not readily available when trying to complete the procedure alone. From giving know-how in legal issues to helping produce a comprehensive prepare for your family's future, there are several advantages of collaborating with an estate planning attorney

Estate attorneys have extensive experience in understanding the subtleties of numerous lawful records such as wills, counts on, and tax laws which enable them to give audio advice on just how best to secure your possessions and guarantee they are passed down according to your desires. An estate attorney will certainly additionally have the ability to give suggestions on exactly how ideal to browse complex estate legislations in order to make sure that your dreams are honored and your estate is handled properly.

The Greatest Guide To Estate Planning Attorney

They can frequently give suggestions on exactly how best to update or produce brand-new files when needed. This may include recommending adjustments in order to make the most of brand-new tax advantages, or simply guaranteeing that all pertinent records show the most present beneficiaries. These lawyers can additionally give ongoing updates associated with the administration of trust funds and other estate-related matters.

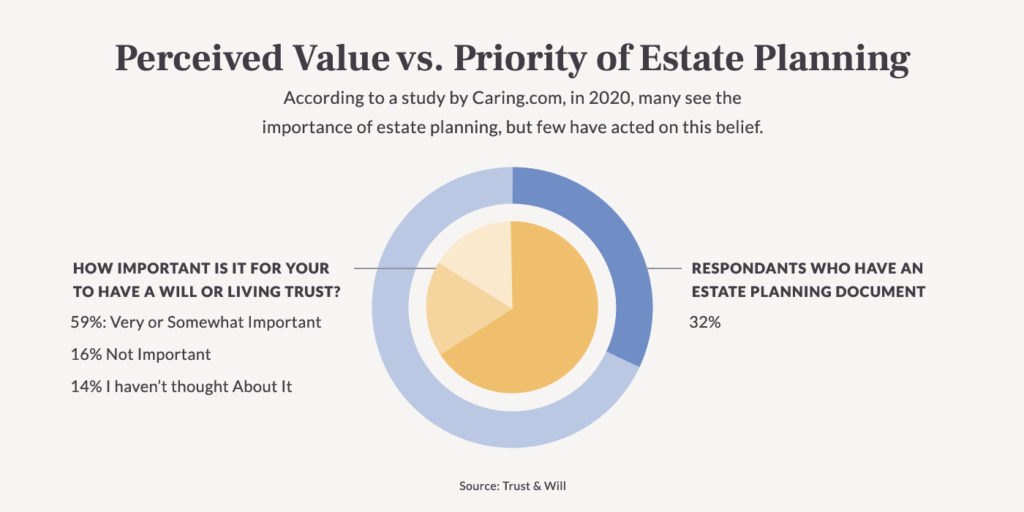

The goal is always to guarantee that all documents stays legally exact and mirrors your present wishes properly. A major advantage of collaborating with an estate preparation attorney is the vital advice they supply when it pertains to preventing probate. Probate is the lawful procedure throughout which a court determines the validity of a dead individual's will and oversees the circulation of their assets based on the terms of that will.

A knowledgeable estate lawyer can assist to make sure that all needed files are in area and that any assets are properly dispersed according to the regards to a will, staying clear of probate entirely. Ultimately, functioning with a skilled estate planning lawyer is just one of the best methods to ensure your want your family's future are performed accordingly.

They provide crucial legal assistance to make sure that the finest passions of any small kids or grownups with impairments are fully safeguarded (Estate Planning Attorney). In such cases, an estate attorney will assist identify ideal guardians or conservators and make sure that they are offered the authority essential to manage the possessions and events of their charges

Estate Planning Attorney Things To Know Before You Get This

Such trusts commonly contain provisions which shield advantages gotten via government programs while permitting trustees to maintain minimal control over just how assets are taken care of in order to take full advantage of benefits for those entailed. Estate attorneys understand exactly how these trust funds work and can supply important assistance establishing them up effectively and ensuring that they stay legally compliant gradually.

An estate planning lawyer can assist a parent include stipulations in their will for the care and management of their small youngsters's properties. Lauren Dowley is a knowledgeable estate preparation lawyer that can aid you develop a plan that satisfies your details needs. She will collaborate with you to understand your properties and how you desire them linked here to be distributed.

Don't wait to start estate preparation! It's one of the most important points you can do for yourself and your enjoyed ones.

The Basic Principles Of Estate Planning Attorney

Creating or upgrading existing estate planning documents, consisting of wills, depends on, healthcare instructions, powers of lawyer, and related devices, is one of the most vital points you can do to ensure your dreams will certainly be recognized when you pass away, or if you come to be incapable to manage your events. In today's digital age, there is no lack of diy options for estate preparation.

Doing so could result in your estate plan not doing what you desire it to do. Wills, my website depends on, and other estate intending records ought to not be something you prepare once and never ever revisit.

Probate and depend on legislations are state-specific, and they do change from time-to-time. Dealing with an attorney can offer you peace of mind understanding that your strategy fits within the criteria of state regulation. One of the greatest risks of taking a diy approach to estate preparation is the risk that your files won't absolutely accomplish your goals.

What Does Estate Planning Attorney Mean?

They will certainly consider various circumstances with you to draft records that properly mirror your wishes. One typical misconception is that your will certainly or trust fund instantly covers all like this of your properties. The fact is that particular types of residential property possession and recipient classifications on assets, such as retired life accounts and life insurance, pass independently of your will or trust fund unless you take steps to make them work together.

Report this page